Insurance Protection for Small Businesses

As a growing small business, you have various insurance needs so that you and your employees are protected. Small business insurance, from health insurance to small business liability insurance, provides confidence that your assets are protected.

Finding The Best Small Business Insurance For You

By taking the time to talk with you about the insurance needs of your small business, we'll evaluate the best coverage for you at the right cost, including:

- Health insurance for small business owners - health insurance is complex, so we'd love to talk about your unique situation and find the best option for you

- Workers’ Compensation - most states require small businesses to have workers' compensation for your employee. This coverage provides benefits to employees for work-related injuries and illnesses.

- General Liability Insurance - third party coverage that helps protect your small business from the costs of property damage, bodily injury, personal and advertising injury. Read our article on why small business liability insurance is important.

- Commercial Auto Insurance - helps your small business cover the costs resulting from an auto accident if you or an employee is found at fault.

- Property Insurance - provides protection for your small business properties in the event of natural disasters, fire and flooding. Learn more about the two most common types of small business property insurance.

Additional insurance coverage options:

- Equipment Breakdown

- Business Interruption

- Cyber Liability

- Employment Practice Liability

- Umbrella Coverage

- Professional Liability

- Bonding

- Directors and Officers Liability

- Builders Risk

- Employment Practice Liability

- Pollution Liability

- Ocean and Inland Marine

To learn more about small business insurance, call us at 1-877-367-3242, connect with a member of our team, or complete the online form below and one of our team members will contact you. We'll provide a complimentary review of your current small business insurance coverage and work together to get the best insurance plan for you.

Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA/SIPC.

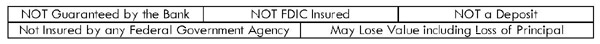

Infinex and Global Credit Union Bank are not affiliated. Products and services made available through Infinex are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value.